Bybit’s Ben Zhou Rejects Pi Network Listing, Ignites Exchange Debate

Bybit's Ben Zhou Rejects Pi Network Listing, Ignites Exchange Debate

The cryptocurrency world is no stranger to controversy, but the recent clash between Bybit CEO Ben Zhou and the Pi Network has reignited a fierce debate about the responsibilities of exchanges and the legitimacy of certain blockchain projects. Pi Network, a mobile-focused cryptocurrency initiative, has long been a subject of intense scrutiny and division within the crypto community. Its promise of accessible mining through smartphones has attracted millions of users worldwide, but allegations of pyramid scheme-like behavior have cast a shadow over its operations.

Enter Ben Zhou, the outspoken CEO of Bybit, one of the largest cryptocurrency exchanges globally. In a move that sent shockwaves through the industry, Zhou publicly rejected requests to list Pi Network on his platform. His blunt refusal, coupled with a candid explanation rooted in personal experience, has not only intensified the conversation around Pi Network but also raised important questions about the role of exchanges in vetting and listing tokens.

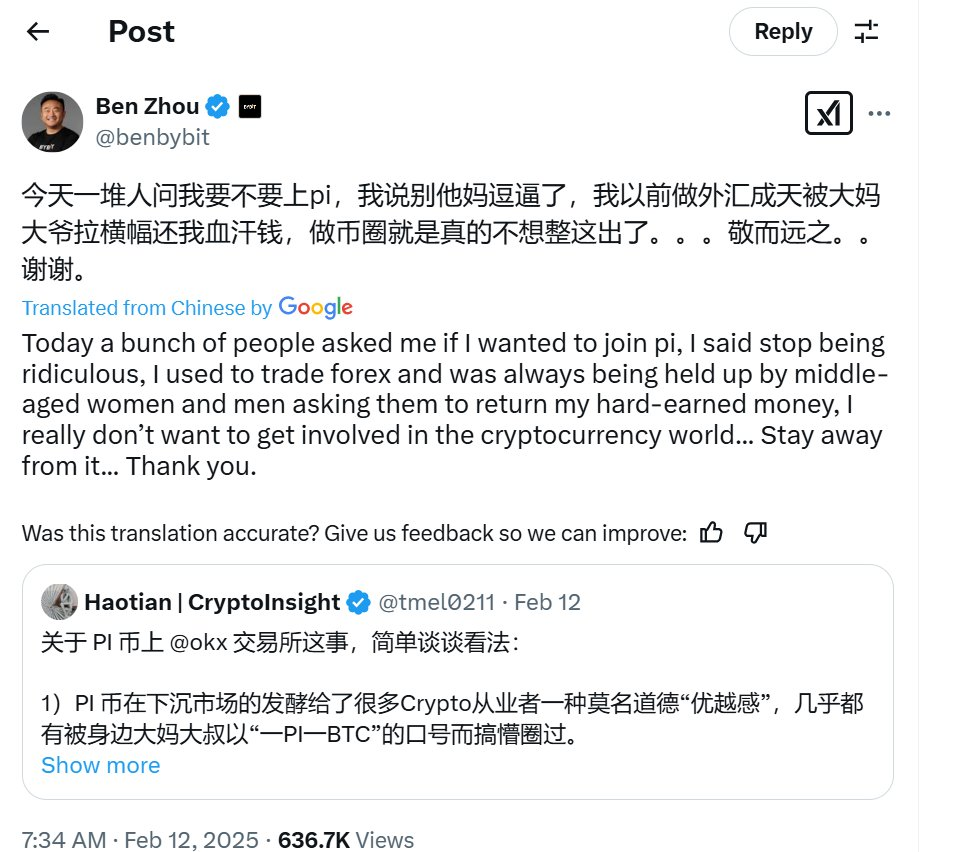

今天一堆人问我要不要上pi,我说别他妈逗逼了,我以前做外汇成天被大妈大爷拉横幅还我血汗钱,做币圈就是真的不想整这出了。。。敬而远之。。谢谢。 https://t.co/mdCApmciE4

— Ben Zhou (@benbybit) February 12, 2025

This story has captured the attention of crypto enthusiasts, industry insiders, and casual observers alike. It embodies the ongoing tension between innovation and controversy that defines much of the blockchain space. On one side, we have a project that claims to democratize cryptocurrency mining and bring blockchain technology to the masses. On the other, we have established industry players like Zhou, who are wary of associating with projects that could potentially harm investors or damage the reputation of the broader crypto ecosystem.

As we delve deeper into this unfolding drama, we'll explore the origins of Pi Network, the reasons behind its divisive reputation, and the implications of Zhou's stance for both the project and the cryptocurrency industry as a whole. This clash serves as a microcosm of the larger debates surrounding crypto innovation, accountability, and the delicate balance exchanges must strike between offering new opportunities and protecting their users.

Pi Network: A Magnet for Controversy

The Origins and Vision of Pi Network

Pi Network burst onto the cryptocurrency scene with a bold promise: to put the power of crypto mining into the hands of everyday people through their smartphones. Launched in 2019 by a team of Stanford graduates, the project positioned itself as a revolutionary approach to blockchain technology, aiming to create a more inclusive and accessible cryptocurrency ecosystem.

The core idea behind Pi Network is simple yet appealing. Users can “mine” Pi coins by simply opening an app on their phone and clicking a button once every 24 hours. This process doesn't drain battery life or require expensive hardware, making it an attractive entry point for those new to cryptocurrency. The network relies on a consensus algorithm called the “Stellar Consensus Protocol,” which it claims is more energy-efficient than traditional proof-of-work systems used by Bitcoin and other cryptocurrencies.

Pi Network's community-driven approach has been central to its growth strategy. The project encourages users to invite friends and family to join the network, creating a rapidly expanding user base. This referral system is touted as a way to build a robust and engaged community, essential for the network's security and adoption.

However, this very system that has fueled Pi's growth has also become a major point of contention among critics and skeptics.

Allegations of Pyramid Scheme Behavior

The controversy surrounding Pi Network reached a boiling point when allegations surfaced, particularly in China, accusing the project of operating like a pyramid scheme. These accusations stem from the network's heavy reliance on its referral system and the lack of a functioning blockchain or tradeable token for much of its existence.

Critics argue that Pi Network's model bears a striking resemblance to multi-level marketing (MLM) schemes. The emphasis on recruitment, with rewards tied to bringing in new members and building “mining teams,” has raised red flags for many in the crypto community. This structure, they claim, prioritizes network growth over technological development or real-world utility.

The project's lengthy “pre-mainnet” phase, during which coins were mined but not tradeable or usable, further fueled skepticism. This extended period without a functional blockchain led some to question whether Pi Network was more focused on accumulating user data than delivering a genuine cryptocurrency product.

These allegations haven't been confined to China. As Pi Network gained global attention, similar concerns were echoed in various jurisdictions, leading to increased scrutiny from regulators and crypto enthusiasts alike.

Polarizing Opinions

The debate surrounding Pi Network has created a stark divide in the crypto community. Supporters of the project passionately defend its vision and potential. They argue that Pi Network is democratizing access to cryptocurrency, allowing individuals who might otherwise be excluded from the crypto revolution to participate. Advocates point to the project's large user base – reportedly in the tens of millions – as evidence of its appeal and potential impact.

These supporters see Pi Network as a long-term project aimed at gradual, sustainable growth. They argue that the extended development period is necessary to build a robust network and ecosystem before launching fully. The community aspect, they contend, is not just about recruitment but about educating and preparing a global user base for the future of decentralized finance.

On the other side, critics remain deeply skeptical of Pi Network's legitimacy and intentions. They point to the lack of transparency regarding the project's tokenomics, the absence of a public blockchain explorer for much of its history, and the unclear roadmap to mainnet launch as major red flags. Skeptics argue that the project's model is unsustainable and potentially exploitative, capitalizing on the hopes and dreams of individuals new to cryptocurrency without delivering tangible value.

This polarization sets the stage for the recent controversy involving Bybit CEO Ben Zhou and his public rejection of Pi Network.

Ben Zhou's Blunt Refusal to List Pi

The Public Reaction to Zhou's Comments

On February 14, 2025, Ben Zhou, the CEO of Bybit, one of the world's leading cryptocurrency exchanges, took to X (formerly known as Twitter) to address the mounting requests for Pi Network listing. His response was as unexpected as it was unequivocal:

“A bunch of people asked me today if I wanted to list Pi. I said, ‘Don't mess with me.' Back when I traded forex, I had elderly investors waving banners demanding their money back. I don't want that drama in crypto. I'll keep my distance. Thanks.”

This blunt statement quickly went viral within the crypto community, sparking intense discussions and debates. Zhou's refusal to entertain the idea of listing Pi Network resonated strongly with skeptics who had long harbored doubts about the project. His words seemed to validate their concerns and lend credibility to the criticisms that had been circulating.

At the same time, Pi Network supporters were taken aback by the directness of Zhou's rejection. Many viewed it as an unfair dismissal of a project they believed in, arguing that Zhou's personal experiences shouldn't dictate Bybit's listing policies.

Linking Pi Network to Zhou's Forex Trading Experience

What made Zhou's comments particularly impactful was his reference to his past experiences in the forex market. By drawing a parallel between the potential fallout from listing Pi Network and the angry investors he encountered in forex trading, Zhou provided a personal context for his decision that went beyond typical corporate statements.

This anecdote about elderly investors demanding their money back painted a vivid picture of the risks Zhou perceives in listing controversial projects. It suggested that his concerns weren't just about Bybit's reputation, but about the real-world consequences for individual investors who might get caught up in the hype of a project without fully understanding the risks.

Zhou's desire to avoid “drama” in the crypto space speaks to a broader sentiment among some industry leaders who are wary of the volatile and often contentious nature of cryptocurrency markets. His stance reflects a growing trend towards caution and due diligence in an industry that has often been criticized for its wild speculation and lack of regulation.

Tone and Transparency: A New Standard for CEOs in the Crypto Industry

Ben Zhou's candid response marks a departure from the often guarded and diplomatic language typically employed by CEOs of major exchanges. In an industry where official communications are carefully crafted and vetted, Zhou's straightforward and personal statement stands out.

This level of transparency and willingness to speak plainly about controversial topics could set a new standard for leadership communication in the crypto industry. It demonstrates a commitment to honesty and investor protection that many find refreshing in a space often clouded by hype and exaggeration.

Moreover, Zhou's refusal to list Pi Network, despite apparent demand from some users, shows a prioritization of long-term stability and credibility over short-term gains. This approach could help build trust in Bybit and potentially influence how other exchanges approach listings of controversial projects in the future.

OKX's Contrasting Approach: A Strategic Gamble?

OKX's Decision to List Pi

In stark contrast to Bybit's rejection, OKX, another major cryptocurrency exchange, announced its decision to list Pi Network for trading. This move came as a surprise to many, given the controversy surrounding the project and the reluctance of other major platforms to associate with it.

OKX's decision to list Pi could be seen as a strategic gamble. By providing a platform for Pi trading, OKX positions itself to capture a significant portion of the trading volume if Pi Network gains traction. The large user base that Pi claims to have could translate into a substantial influx of new traders for OKX, potentially boosting its market share and revenue.

Furthermore, by being one of the first major exchanges to list Pi, OKX might be hoping to establish itself as a go-to platform for Pi holders, securing a first-mover advantage in what could become a lucrative market if the project succeeds.

The Risks of Associating with Controversial Projects

However, OKX's decision is not without significant risks. By listing a project that has been accused of operating like a pyramid scheme, OKX exposes itself to potential reputational damage. If Pi Network fails to deliver on its promises or if regulatory bodies take action against the project, OKX could face backlash from users and scrutiny from regulators.

There's also the risk of financial losses for traders on the platform. If Pi's value were to collapse or if the project were to be revealed as fraudulent, OKX might face angry users who feel the exchange should have conducted more thorough due diligence before listing the token.

The crypto industry has seen numerous cases where exchanges faced severe consequences for listing tokens that later turned out to be scams or failed projects. These incidents have led to loss of user trust, regulatory crackdowns, and in some cases, significant financial liabilities for the exchanges involved.

Will OKX Face Backlash?

The long-term consequences of OKX's decision remain to be seen. Much will depend on how Pi Network performs and whether it can address the concerns raised by critics. If Pi succeeds in launching a fully functional blockchain and proves its critics wrong, OKX's gamble could pay off handsomely. The exchange could be praised for its foresight and willingness to support innovative projects.

However, if Pi Network fails to deliver or faces regulatory challenges, OKX could find itself in a difficult position. The exchange might need to defend its decision-making process and potentially deal with user complaints or regulatory inquiries.

Comparisons can be drawn to other exchanges that have faced similar dilemmas in the past. For instance, the fallout from the collapse of projects like BitConnect and OneCoin led to increased scrutiny of exchanges that had listed these tokens. In some cases, exchanges were forced to delist tokens and compensate users, damaging both their finances and reputation.

OKX's decision to list Pi Network while other major exchanges hesitate highlights the complex decisions exchanges must make in balancing user demand, potential profit, and risk management. It also underscores the ongoing debate within the crypto industry about the role of centralized exchanges in vetting and legitimizing new projects.

The Role of Other Exchanges: Cautious or Opportunistic?

Bitget's Quiet Retreat

While OKX made headlines with its decision to list Pi Network, other exchanges have taken a more cautious approach. Bitget, another significant player in the cryptocurrency exchange market, initially showed interest in Pi Network but has since quietly distanced itself from the project.

According to reports, Bitget removed promotional content related to Pi Network shortly after previously announcing support for the token. This sudden reversal suggests that the exchange may have reassessed the risks associated with listing Pi, possibly in light of the growing controversy and the stance taken by other major exchanges like Bybit.

Bitget's retreat from Pi Network is particularly telling. It demonstrates the delicate balance exchanges must strike between capturing market opportunities and managing risk. The removal of promotional content without a formal announcement indicates a desire to distance the exchange from Pi Network without drawing attention to the change in stance.

This cautious approach reflects the broader hesitation in the exchange ecosystem when it comes to controversial projects like Pi Network.

The Broader Hesitation in the Exchange Ecosystem

The reluctance of many exchanges to list Pi Network stems from a combination of factors. First and foremost is the concern over regulatory compliance. With increased scrutiny from financial regulators worldwide, exchanges are becoming more cautious about the projects they associate with. Listing a token that could potentially be classified as a security or deemed a pyramid scheme could invite unwanted attention from regulatory bodies.

Additionally, exchanges are increasingly aware of the reputational risks involved in listing controversial tokens. The crypto industry has matured significantly in recent years, and established exchanges are prioritizing long-term stability and credibility over short-term gains from listing every new token that generates buzz.

There's also the technical aspect to consider. Exchanges need to ensure that a token's blockchain is secure, scalable, and compatible with their trading infrastructure. Given the questions surrounding Pi Network's technological development, some exchanges may be hesitant to invest resources in integrating a project with an uncertain future.

Community Pressure and Exchange Decisions

The relationship between exchanges and their user bases plays a crucial role in listing decisions. While user demand can influence an exchange's choices, as evidenced by the numerous requests Ben Zhou received to list Pi, exchanges must balance this demand against their responsibility to protect users and maintain the integrity of their platforms.

Exchanges often find themselves in a challenging position. On one hand, they want to offer their users access to a wide range of trading options and emerging projects. On the other hand, they need to act as gatekeepers, conducting due diligence to protect their users from potential scams or highly risky investments.

The power dynamic between exchanges and their users is complex. While users can exert pressure through social media campaigns or by threatening to move to other platforms, ultimately, exchanges hold significant power in shaping the crypto landscape through their listing decisions.

In the case of Pi Network, we see this dynamic playing out in real-time. Despite apparent demand from some users, major exchanges like Bybit are choosing to prioritize caution and user protection over meeting every request for new listings.

The Larger Debate: Crypto Innovation vs. Accountability

The Dilemma of Listing Controversial Tokens

The controversy surrounding Pi Network and the varied responses from different exchanges highlight a fundamental dilemma in the cryptocurrency industry: how to balance support for innovation with the need for accountability and user protection.

On one side of this debate are those who argue that exchanges should be more open to listing new and experimental projects. They contend that by providing a platform for emerging tokens, exchanges can foster innovation and give users the freedom to make their own investment decisions. Supporters of this view might argue that projects like Pi Network, despite their controversies, represent attempts to make cryptocurrency more accessible to a broader audience.

On the other hand, there are those who believe that exchanges have a responsibility to thoroughly vet the projects they list, acting as a first line of defense against potential scams or unsound investments. This camp would argue that listing controversial tokens like Pi Network could expose unsophisticated investors to undue risk and damage the credibility of the entire crypto ecosystem.

This dilemma is not new to the crypto world. Throughout the industry's history, there have been numerous cases of tokens that generated significant hype and user interest, only to later be revealed as scams or fundamentally flawed projects. The fallout from such cases has often led to calls for greater scrutiny and more stringent listing criteria from exchanges.

The Need for Better Transparency

The Pi Network controversy underscores the critical importance of transparency in the cryptocurrency space. One of the main criticisms leveled against Pi Network has been the lack of clear information about its tokenomics, development progress, and plans for mainnet launch.

For the crypto industry to mature and gain wider acceptance, projects need to prioritize transparency. This includes providing detailed white papers, regular development updates, and clear roadmaps. Exchanges, too, have a role to play in demanding and verifying this information before making listing decisions.

Controversies like the one surrounding Pi Network challenge the industry's credibility. They highlight the need for better standards and practices across the board, from project development to exchange listings. As the industry evolves, there's a growing recognition that long-term success depends on building trust with users, regulators, and the broader financial community.

Ben Zhou's Leadership Philosophy

A CEO Who Values Stability Over Hype

Ben Zhou's public rejection of Pi Network offers insights into his leadership philosophy and vision for Bybit. His stance demonstrates a clear prioritization of long-term stability and credibility over short-term gains that might come from listing a hyped but controversial token.

This approach aligns with a growing trend in the crypto industry towards more responsible and sustainable business practices. As the market matures, leaders like Zhou are recognizing the importance of building trust and maintaining a reputation for reliability and user protection.

Zhou's decision to speak out against listing Pi Network, despite apparent demand from some users, shows a willingness to make tough decisions that may not be universally popular in the short term. This kind of leadership is crucial in an industry that has often been driven more by hype and speculation than by sound business principles.

How Zhou's Forex Background Shapes His Crypto Strategy

Zhou's reference to his experiences in the forex market provides valuable context for understanding his approach to running a crypto exchange. The forex market, known for its high volatility and potential for significant losses, seems to have left a lasting impression on Zhou.

By drawing parallels between the potential fallout from listing Pi Network and the angry investors he encountered in forex trading, Zhou demonstrates a keen awareness of the real-world consequences of exchange decisions. This perspective likely informs Bybit's overall strategy, emphasizing risk management and user protection.

Zhou's desire to avoid “drama” in the crypto space speaks to a broader goal of bringing stability and professionalism to an industry often characterized by its wild swings and controversial projects. By taking a stand against listing tokens he views as potentially problematic, Zhou is positioning Bybit as a more conservative and trustworthy platform in a sea of exchanges willing to list almost anything for short-term gain.

Setting a Precedent for Other Crypto Leaders

Zhou's public stance on Pi Network could have ripple effects throughout the crypto industry. By openly discussing his reasons for rejecting the listing, Zhou has set a precedent for transparency and decisiveness among exchange leaders.

This move could encourage other CEOs and exchange operators to be more forthcoming about their listing criteria and decision-making processes. It might also embolden other industry leaders to speak out against projects they view as potentially harmful or fraudulent, even if those projects have a significant following.

In the long run, this kind of leadership could contribute to a more mature and trustworthy cryptocurrency ecosystem. As more leaders prioritize stability and user protection over short-term gains, the industry as a whole may shift towards more sustainable and responsible practices.

The Future of Pi Network Amid Growing Pushback

Pi Network's Fight for Legitimacy

In the face of growing skepticism and rejection from major exchanges like Bybit, Pi Network faces an uphill battle to establish its legitimacy in the cryptocurrency world. The project's future success will largely depend on its ability to address the concerns raised by critics and deliver on its promises to users.

One of the key challenges for Pi Network will be to provide greater transparency about its technology, tokenomics, and development progress. The project will need to clearly demonstrate that it has a viable and sustainable model that goes beyond its controversial referral system.

Additionally, Pi Network will need to successfully launch its mainnet and provide real utility for its tokens. Until users can actually use or trade their Pi coins, skepticism about the project's intentions and capabilities is likely to persist.

Can Pi Sustain Its Community's Momentum?

Pi Network's greatest asset has been its large and enthusiastic community of users. However, maintaining this momentum in the face of growing criticism and exchange rejections could prove challenging.

The project will need to find ways to keep its community engaged and motivated, especially if the path to mainnet launch and real-world utility for Pi coins is longer than anticipated. This could involve providing more frequent updates, offering clearer roadmaps, or finding new ways to demonstrate the potential value of the Pi ecosystem.

However, there's a risk that continued delays or negative press could lead to disillusionment among Pi Network's user base. If a significant portion of the community loses faith in the project, it could create a negative feedback loop, making it even harder for Pi to gain legitimacy in the broader crypto world.

The Impact of Exchange Decisions on Pi's Survival

The reluctance of major exchanges to list Pi could have significant implications for the project's future. Without access to large, reputable trading platforms, Pi may struggle to achieve the liquidity and mainstream adoption it needs to thrive.

OKX's decision to list Pi provides a glimmer of hope for the project, potentially opening the door for other exchanges to follow suit. However, if other major players continue to follow Bybit's lead in rejecting Pi, the token could find itself isolated in the crypto ecosystem.

The challenge for Pi Network will be to leverage its large user base and any initial trading activity on platforms like OKX to demonstrate its viability and attract interest from other exchanges. However, this will likely require the project to address the concerns raised by skeptics and provide concrete evidence of its technological and economic soundness.

Conclusion: The Industry at a Crossroads

The controversy surrounding Pi Network and Ben Zhou's emphatic rejection of its listing on Bybit represents more than just a singular event in the crypto world. It symbolizes a critical juncture for the entire cryptocurrency industry, highlighting the ongoing tension between innovation and accountability.

Zhou's stance, rooted in his experiences and commitment to user protection, sets a powerful precedent. It challenges other exchange leaders to prioritize long-term credibility over short-term gains and to take a more active role in vetting the projects they list. This approach could lead to a more mature and trustworthy crypto ecosystem, potentially attracting more mainstream investors and users who have been wary of the industry's wild west reputation.

However, the contrasting decision by OKX to list Pi Network underscores the complex landscape exchanges must navigate. It highlights the difficult balance between meeting user demand, supporting potentially innovative projects, and managing risk. The divergent approaches of Bybit and OKX reflect the broader debate within the crypto community about the role of centralized exchanges in an industry founded on principles of decentralization.

For projects like Pi Network, the road ahead is fraught with challenges. The scrutiny and skepticism they face from major industry players like Zhou serve as a wake-up call, emphasizing the need for greater transparency, clearer communication, and tangible progress. The success or failure of Pi Network in the face of these challenges could have far-reaching implications for how similar projects are perceived and treated in the future.

Looking ahead, the crypto industry stands at a crossroads. The choices made by exchange leaders, project developers, and regulators in the coming months and years will shape the future of digital finance. Will the industry move towards greater accountability and user protection, potentially at the cost of some innovation and experimentation? Or will it continue to embrace a more open, if riskier, approach to new projects and ideas?

The answers to these questions will not only determine the fate of projects like Pi Network but also the broader trajectory of the cryptocurrency revolution. As the industry matures, finding the right balance between innovation and responsibility will be crucial for its long-term success and mainstream adoption.

In this evolving landscape, the voices of leaders like Ben Zhou and the decisions of major exchanges will play a pivotal role. Their actions will help define the standards and practices that guide the industry forward, shaping a future where cryptocurrency can fulfill its promise of financial innovation while building the trust and stability needed for widespread acceptance.

More articles for you

- Become an AI-powered Entrepreneur with These 9 Free AI Courses

- Enroll Now in IBM’s Free Generative AI Courses Available to Everyone in 2025!

- UGC Valet Review: AI Develops Distinct Spokespersons and UGC Videos Featuring REAL Actors That Drive Conversions on TikTok, IG, FB, and YT, Earning Clients $500-$1,000 Per Clip!

- Google Whisk, an Innovative Image Remixing Tool, Is Now Accessible in Over 100 Countries

- Clepher Review: Revolutionary AI Chat Tool that Quadruples Profits, Elevates Conversions, and Cuts Advertising Costs Instantly!

- AI Member Review: A Network That Automatically Builds and Fills Your Account with Gamified Communities Featuring Auto-Generated Content, Videos, Courses, Blogs, and More Across Any Niche

- VidAvatar AI Review: Create Life-Like Digital AI Avatar Videos in 60 Seconds!

- AI Live School Builder Review: Build and Launch Your LIVE School with Pre-Designed AI LIVE Educators, Classes, and Core Subjects including Maths and Science!